Market Commentary | February 16th, 2026

Weekly Market Commentary

February 16th, 2026

Week in Review

Last week’s data reinforced a familiar theme: inflation is cooling, the labor market is stabilizing, and the consumer is becoming more selective.

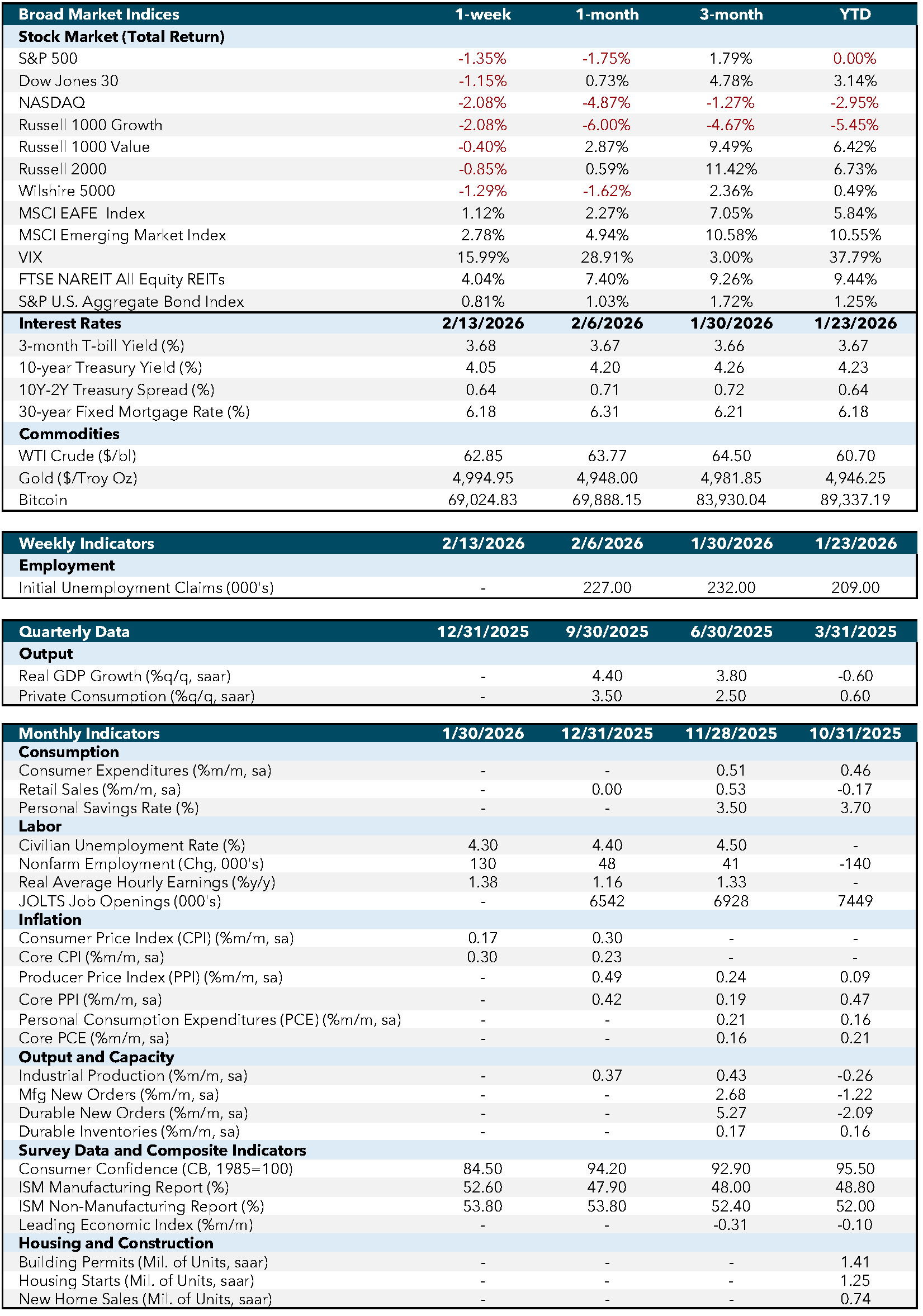

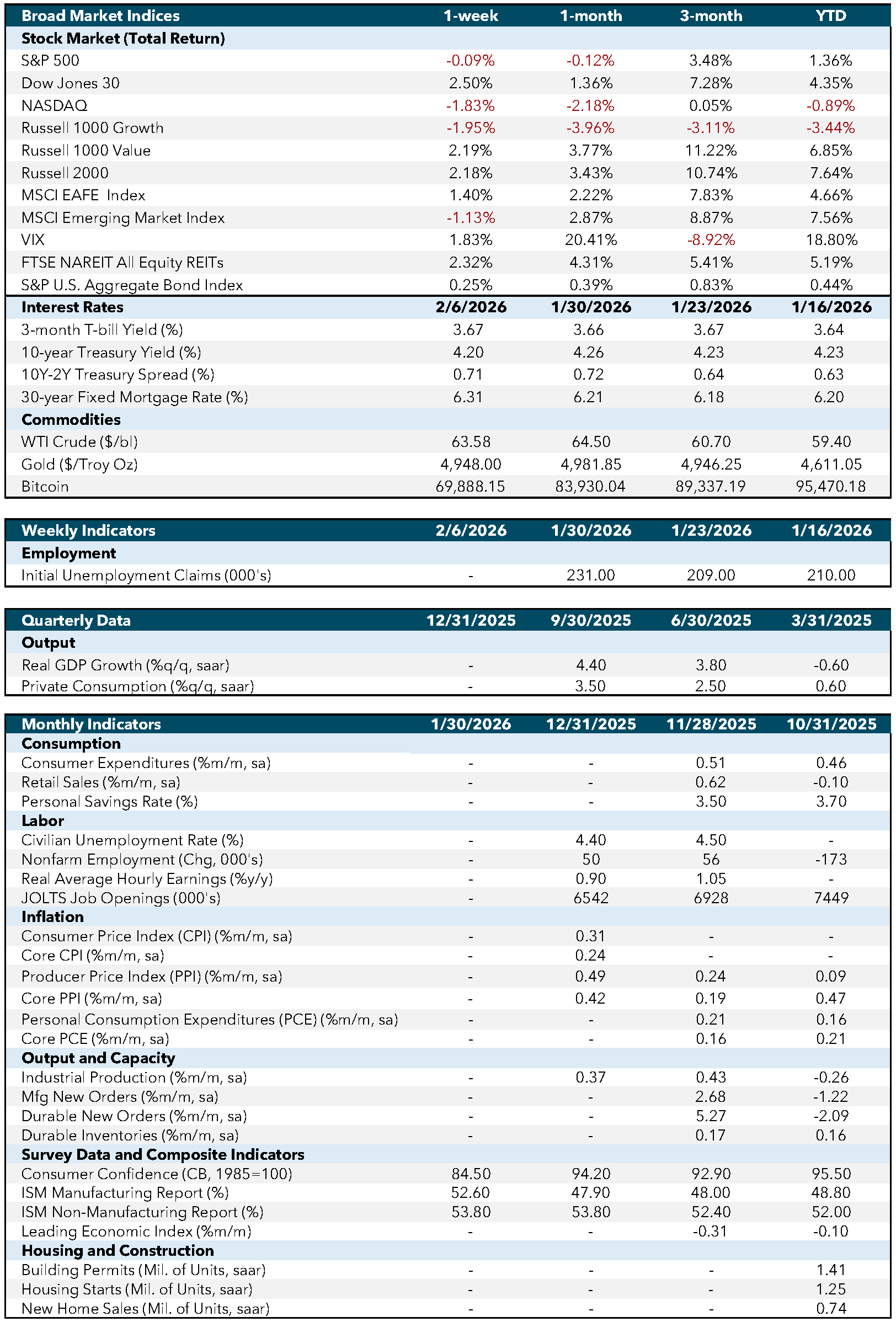

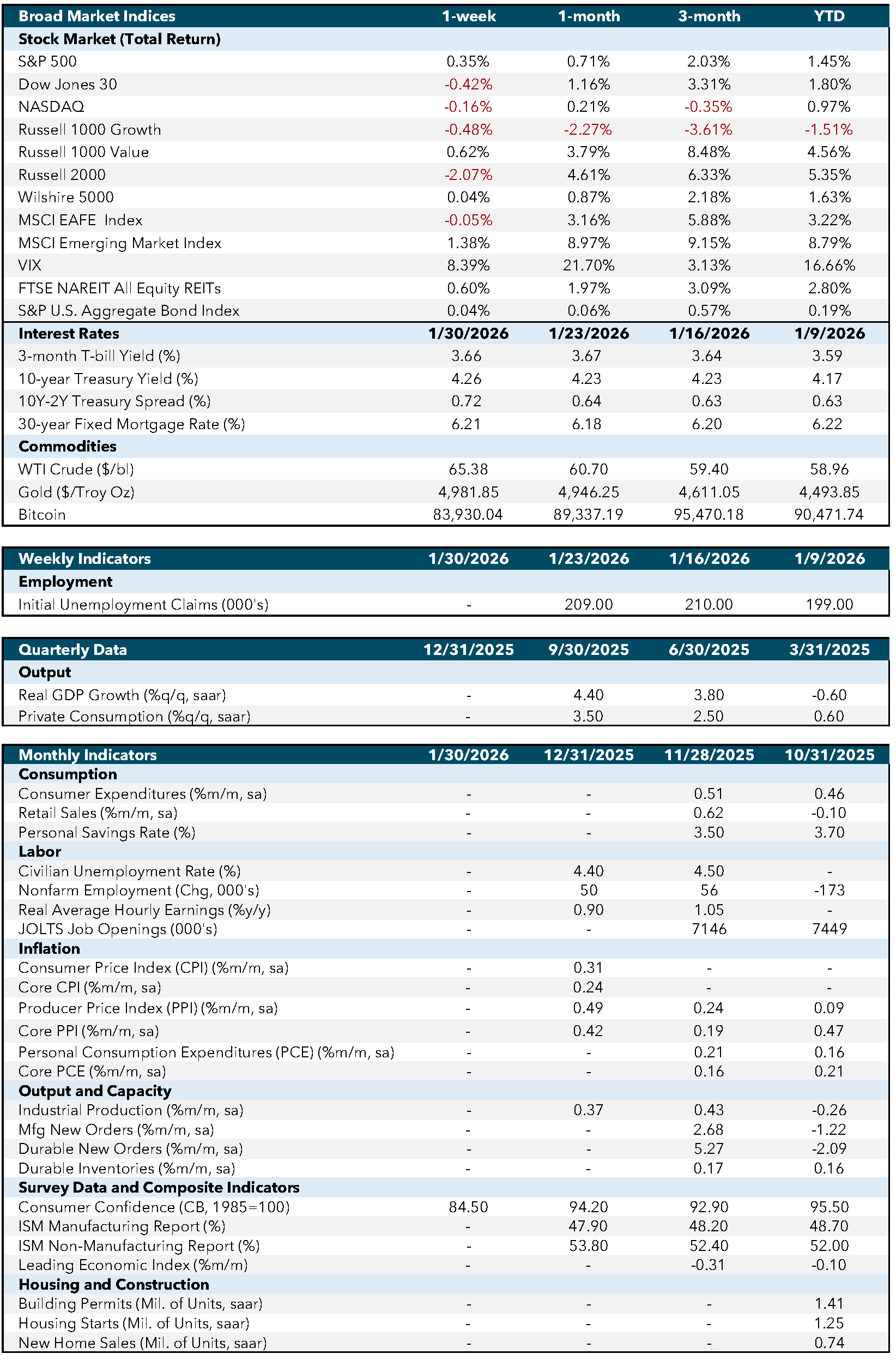

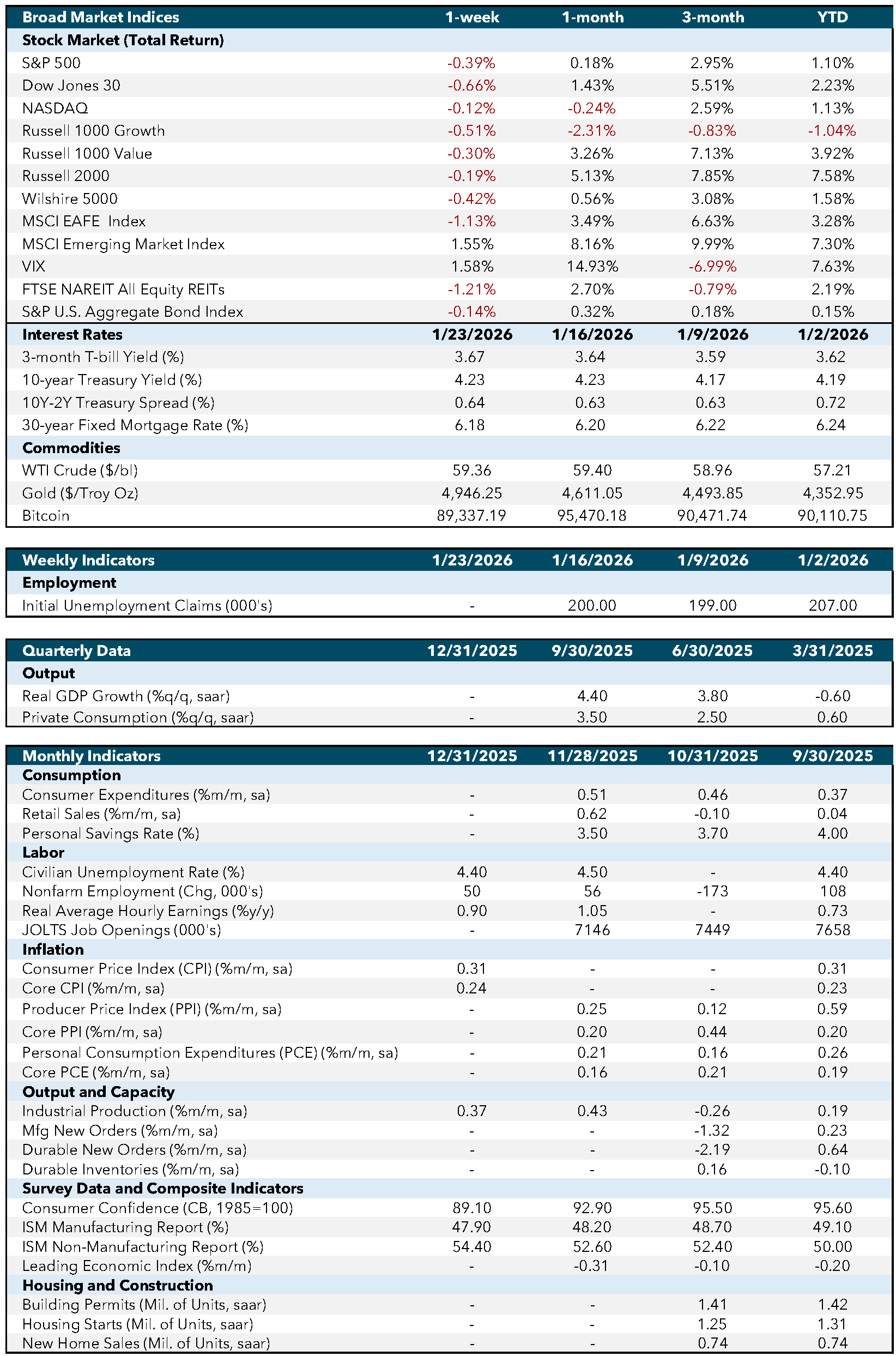

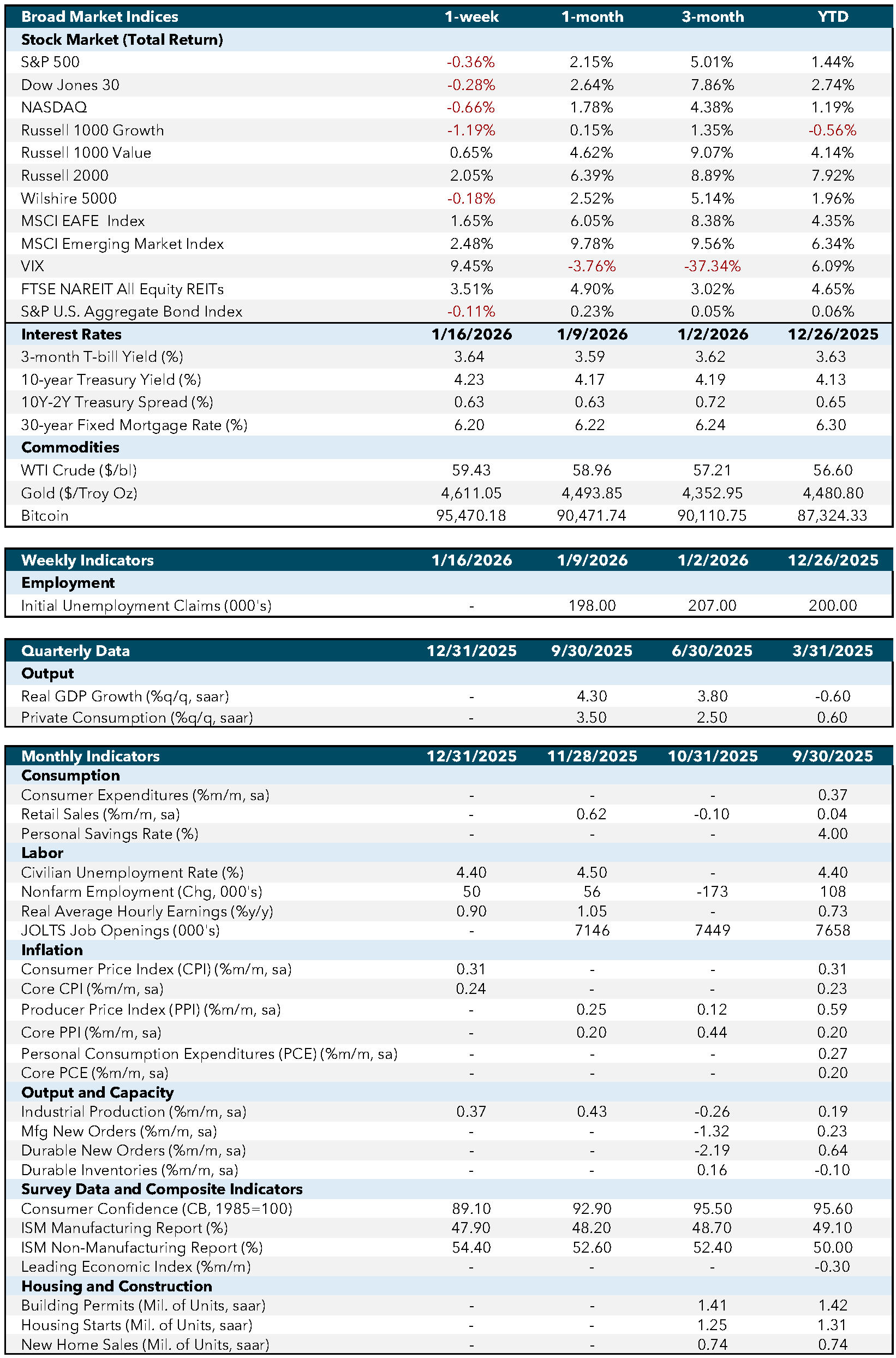

The January Consumer Price Index (CPI) report showed continued, albeit uneven, progress on disinflation. Headline CPI rose 0.2% and eased to 2.4% year-over-year, helped by a 1.5% decline in energy prices that again acted as a drag on the overall index. Core CPI (e.g., food and energy) increased 0.3% for the month and held at 2.5% year-over-year. Beneath the surface, subdued core goods prices continued to counter persistent pressures in labor‑intensive services, while shelter inflation still added to core readings but at a diminishing pace. The marginal contribution of both owners’ equivalent rent and rent of primary residence continued to shrink, reinforcing the broader easing trend in housing costs and suggesting inflation pressures are becoming increasingly concentrated.

The January employment report delivered a notable upside surprise, with payroll growth coming in well above expectations. Yet the composition of job gains suggests the report was more consistent with job market stabilization than overheating. Hiring was concentrated in healthcare and construction, while government and finance weakened. Additionally, average hourly earnings rose 0.4% over the month. Given the sector mix, some of that firmness likely reflected composition rather than a broad-based pickup in wage pressure. Meanwhile, continuing claims edged up, hinting that re-employment is becoming more drawn out even as layoffs remain contained. Encouragingly, labor supply improved as participation rose to 62.5%, and both the unemployment rate and U‑6 declined, led by stronger prime‑age participation.

Even with these labor‑market improvements, markets remain focused on the retail consumer, where last week’s data hinted at softer momentum. December retail sales were flat (0.0% month-over-month) versus 0.3% expected, consistent with a post‑holiday cooldown and a shift toward value‑oriented spending. January existing‑home sales fell 8.4% to a 3.91 million annualized pace. While the series can be distorted by timing, weather, and other transitory factors, the directional message aligns with retail: households are becoming more discerning, and big‑ticket activity remains difficult to sustain. If this pattern persists, the consumer could become less of a growth buffer in early 2026, even as labor conditions remain broadly supportive.

Week Ahead…

This week’s economic calendar shifts the focus from backward‑looking inflation data to forward‑looking sentiment and demand indicators, offering markets an early read on how businesses and consumers are navigating the current environment.

Against that backdrop, markets will be watching whether early‑month sentiment data confirm a cooling in activity or simply reflect short‑term volatility following January’s data‑heavy start to the year. Regional manufacturing surveys from the New York Fed and Philadelphia Fed will provide a first look at February activity and sentiment, often serving as precursors to broader national trends. In particular, markets will be watching the Philadelphia Fed’s employment component, which has historically been a useful barometer for labor demand at the margin.

Consumer sentiment will also be in focus with the release of the University of Michigan sentiment and inflation expectations survey. After recent inflation data showed continued progress but lingering pockets of stickiness, markets will be attentive to whether household inflation expectations remain anchored and how consumers are perceiving their own financial conditions. Given the growing emphasis on the retail consumer as a potential pressure point, this report will help complement the business‑side data with a demand‑side perspective.

The most consequential release of the week will be Friday’s Personal Consumption Expenditures (PCE) inflation report, the Federal Reserve’s preferred gauge of inflation. With markets increasingly sensitive to the timing and pace of future rate cuts, any confirmation that disinflation is continuing, particularly in core PCE, could meaningfully influence policy expectations and rate markets.

Housing data will round out the week, with building permits and housing starts providing insight into future construction activity and housing demand. As leading indicators, these reports are especially important for assessing momentum in the housing sector and, by extension, the health of the household balance sheet. Pending home sales will also be closely watched as an indicator of pipeline activity in the existing‑home market and a signal for transaction volumes in the months ahead.

Economic Indicators:

- CPI: Consumer Price Index measures the average change in prices paid by consumers for goods and services over time. Source: Bureau of Labor Statistics.

- Core CPI: Core Consumer Price Index excludes food and energy prices to provide a clearer picture of long-term inflation trends. Source: Bureau of Labor Statistics.

- PPI: Producer Price Index measures the average change in selling prices received by domestic producers for their output. Source: Bureau of Labor Statistics.

- Core PPI: Core Producer Price Index excludes food and energy prices to provide a clearer picture of long-term inflation trends. Source: Bureau of Labor Statistics.

- PCE: Personal Consumption Expenditures measure the average change in prices paid by consumers for goods and services. Source: Bureau of Economic Analysis.

- Core PCE: Core Personal Consumption Expenditures exclude food and energy prices to provide a clearer picture of long-term inflation trends. Source: Bureau of Economic Analysis.

- Industrial Production: Measures the output of the industrial sector, including manufacturing, mining, and utilities. Source: Federal Reserve.

- Mfg New Orders: Measures the value of new orders placed with manufacturers for durable and non-durable goods. Source: Census Bureau.

- Durable New Orders: Measures the value of new orders placed with manufacturers of durable goods. Source: Census Bureau.

- Durable Inventories: Measures the value of inventories held by manufacturers for durable goods. Source: Census Bureau.

- Consumer Confidence (CB, 1985=100): Measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation. Source: Conference Board.

- ISM Manufacturing Report: Measures the economic health of the manufacturing sector based on surveys of purchasing managers. Source: Institute for Supply Management.

- ISM Non-Manufacturing Report: Measures the economic health of the non-manufacturing sector based on surveys of purchasing managers. Source: Institute for Supply Management.

- Leading Economic Index: Measures overall economic activity and predicts future economic trends. Source: Conference Board.

- Building Permits (Mil. of Units, saar): Measures the number of new residential building permits issued. Source: Census Bureau.

- Housing Starts (Mil. of Units, saar): Measures the number of new residential construction projects that have begun. Source: Census Bureau.

- New Home Sales (Mil. of Units, saar): Measures the number of newly constructed homes sold. Source: Census Bureau.

- SA: Seasonally adjusted.

- SAAR: Seasonally adjusted annual rate.

Market Indices & Indicators:

- S&P 500: A market-capitalization-weighted index of 500 leading publicly traded companies in the U.S., widely regarded as one of the best gauges of large U.S. stocks and the stock market overall.

- Dow Jones 30: Also known as the Dow Jones Industrial Average, it tracks the share price performance of 30 large, publicly traded U.S. companies, serving as a barometer of the stock market and economy.

- NASDAQ: The world’s first electronic stock exchange, primarily listing technology giants and operating 29 markets globally.

- Russell 1000 Growth: Measures the performance of large-cap growth segment of the U.S. equity universe, including companies with higher price-to-book ratios and growth metrics.

- Russell 1000 Value: Measures the performance of large-cap value segment of the U.S. equity universe, including companies with lower price-to-book ratios and growth metrics.

- Russell 2000: A market index composed of 2,000 small-cap companies, widely used as a benchmark for small-cap mutual funds.

- Wilshire 5000: A market-capitalization-weighted index capturing the performance of all American stocks actively traded in the U.S., representing the broadest measure of the U.S. stock market.

- MSCI EAFE Index: An equity index capturing large and mid-cap representation across developed markets countries around the world, excluding the U.S. and Canada.

- MSCI Emerging Market Index: Captures large and mid-cap representation across emerging markets countries, covering approximately 85% of the free float-adjusted market capitalization in each country.

- VIX: The CBOE Volatility Index measures the market’s expectations for volatility over the coming 30 days, often referred to as the “fear gauge.”

- FTSE NAREIT All Equity REITs: Measures the performance of all publicly traded equity real estate investment trusts (REITs) listed in the U.S., excluding mortgage REITs.

- S&P U.S. Aggregate Bond Index: Represents the performance of the U.S. investment-grade bond market, including government, corporate, mortgage-backed, and asset-backed securities.

- 3-Month T-bill Yield (%): The yield on U.S. Treasury bills with a maturity of three months, reflecting short-term interest rates.

- 10-Year Treasury Yield (%): The yield on U.S. Treasury bonds with a maturity of ten years, reflecting long-term interest rates.

- 10Y-2Y Treasury Spread (%): The difference between the yields on 10-year and 2-year U.S. Treasury bonds, often used as an indicator of economic expectations.

- WTI Crude ($/bl): The price per barrel of West Texas Intermediate crude oil, a benchmark for U.S. oil prices.

- Gold ($/Troy Oz): The price per troy ounce of gold, a standard measure for gold prices.

- Bitcoin: A decentralized digital currency without a central bank or single administrator, which can be sent from user to user on the peer-to-peer bitcoin network.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.

Securities offered through Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC, and investment advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Both are wholly-owned subsidiaries of Cambridge Investment Group, Inc. V.CIR.0226-0607